Downloads

AGM Notice

AGM Results

AGM Recording

Introduction to Notice of AGM 2024

The tenth annual general meeting of the Company will be held at 12:00 noon on 12 August 2024.

A number of Resolutions are being proposed in relation to the ordinary administrative business of the Company.

Full details of the Resolutions to be proposed are set out in the AGM Notice 2024 in Part 3 and explanatory notes to the Resolutions are set out in Part 4 under the heading “Explanatory Notes to the Resolutions to be proposed at the AGM”.

The AGM Notice 2024 explains in more detail one of the proposals which relates to the continuation of the Company, Resolution 14 (the “Discontinuation Resolution”), and why the Board unanimously recommends that Shareholders VOTE AGAINST the Discontinuation Resolution.

Direct Link to AGM Notice 2024 here

The Board of Directors’ Full Voting Recommendations

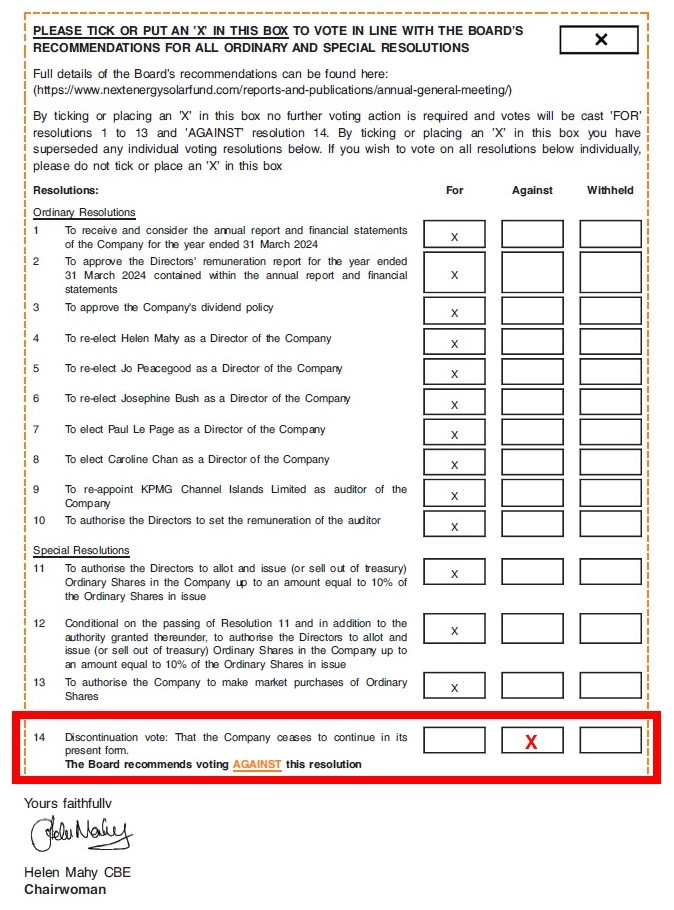

Please find here a completed Form of Proxy example of how the Board would recommend voting at this AGM. As noted, there are two ways in which Shareholders can vote, either by ticking or putting an ‘X’ in the first box to select voting in line with the Board’s recommendations or by selecting the individual resolutions below.

Background and Rationale to Vote Against Discontinuation (Special Resolution 14)

The Company launched on the London Stock Exchange in April 2014, having raised £85.6 million of equity. Since 2014, the Company has grown substantially, with a total of £591.9 million in equity raised and a Gross Asset Value of £1,155 million as at 31 March 2024. The Company has become a FTSE 250 constituent, increased its high-quality portfolio to 103 operating assets as at 31 March 2024, achieved its first 1GW installed capacity milestone during that financial year, and delivered a total Shareholder return of 49% and a total Net Asset Value (“NAV”) return of 73% since launch to 30 June 2024, inclusive of dividends and the current Ordinary Share price discount to NAV. NESF prides itself on its transparent approach to sustainability disclosures, including meeting the requirements of Article 9 of the European Union Sustainable Finance Disclosure Regulation and being fully aligned with the EU Taxonomy.

The Company’s investment objective is to provide Shareholders with attractive risk-adjusted returns, principally in the form of regular dividends, by investing in a diversified portfolio of utility-scale solar energy and energy storage infrastructure assets. The Company has consistently achieved this objective by providing Shareholders with a covered and growing dividend every year for the last 10 years, having paid out £345 million (67.8 pence per Ordinary Share) since its IPO, all whilst contributing significantly to the UK’s renewable energy electricity generation. The Company maintains a progressive annual dividend policy, whilst preserving the capital value of its investment portfolio through reinvestment of excess cash flow.

The Company is well positioned not only to remain relevant but to continue to deliver on its objectives for the long term, which is evident through its commitment to narrow its current Ordinary Share price discount to NAV. The Company took decisive action against this discount to set out a clear roadmap through its Capital Recycling Programme (CRP) which has made significant progress over the last 12 months, with the sale of Hatherden, a 60MW ready-to-build solar project, and more recently by successfully delivering the sale of Whitecross, a 35MW operational subsidy-free solar asset, both at attractive premiums to their holding values in the Company’s NAV. The remaining 150MW of the 246MW Capital Recycling Programme continues to progress through a competitive sales process to third-party buyers. The Company will publish further updates about Phase III of the Programme in due course. At the same time, the Company has remained disciplined across its capital structure and launched a meaningful Share buyback programme of up to £20 million to seek to narrow the discount in the Ordinary Share price and provide maximum value to Shareholders.

Under the careful stewardship of the Board, the Investment Manager and the Investment Adviser (NextEnergy Capital), the Board believes the Company continues to provide long-term attractive value for its Shareholders and therefore unanimously recommends that Shareholders VOTE AGAINST special resolution 14 (the Discontinuation Resolution).